September is declared by some to be the worst month of the year: the post-holiday depression is joined by the September 1st payments and the back to school, which can be a major challenge to our wallets. But don’t worry, at Moneytrans we have the solution to put a smile back on your face: 3 simple keys to financial literacy that will help you approach this back to school with optimism. Are you in?

1. WHAT IS FINANCIAL LITERACY?

1.1 CONCEPT OF FINANCIAL LITERACY

What is financial literacy? It is the key to your finances and, above all, to your peace of mind! Financial literacy is the knowledge that allows us to better manage our money because we understand the economic context in which we operate and this allows us to make the best decisions. It is not a matter of being an expert, but of having the keys to manage your expenses and income and to choose the financial services that are most convenient for you and your family.

Financial literacy has much more to do with psychology and habits than with money. Cultivate your mind in every way, and cultivate it in financial matters as well. Understanding how to make smart financial decisions and learning the difference between desires and needs is more important than ever. It seems obvious, but many people forget this simple rule.

Food, housing, access to basic health services, public education, water, electricity or gas supplies, or being able to deal with an unexpected problem with your savings should come first when it comes to your financial priorities. Having a car may be a need, but buying an overpriced car is probably a desire. Financial literacy will help you differentiate between needs or desires for managing your finances in ways that are most beneficial to your wallet! Join in?

1.2 BENEFITS OF FINANCIAL LITERACY

Financial literacy brings great benefits to your day-to-day life. Do you want to know it?

- It will help you to save money! And not only you, your remittances will also benefit from these savings!

- It allows you to manage your expenses and income more effectively.

- The more control you have over your finances, the more aware you are of your financial situation and, as a result, you will consume more responsibly!

- Financial literacy prevents possible financial fraud or scams, and knowing how to detect them will prevent you from being too worried!

- The more informed you are, the easier it will be for you to make a decision – the decision that best suits your needs!

- A thorough control of your expenses will make you make ends meet more relaxed.

- Financial literacy will allow you to better understand the economic context of your country of residence or the one of your loved ones in your home country.

- You’ll have the basic knowledge to deal with a contract, understand a payslip, the requirements for opening a bank account or the taxes to be paid. You won’t be afraid of fine print any more!

- Finally, the fact that you have a financial literacy will enable you to educate your children and help them to make the best decisions about their finances in the future – and that’s priceless!

2. KEYS TO IMPROVING YOUR FINANCIAL LITERACY

Many people lack the financial skills to open their bank accounts, manage their income, control their expenses, save money or understand all the information that affects their finances. But today, we are taking the first step! To improve our financial literacy, it is essential that we know the keys to managing our finances:

2.1 EXPENSES

2.1.1 EXPENDITURE CONTROL

It’s not easy, we know it! Every month the expenses stress us and give us more than one headache. However, financial literacy will also help you with your expenses! One of the main keys is to be fully aware of all your expenses, even the smallest ones! Who hasn’t experienced that at the end of the month you don’t know what you have spent small amounts of money on, and that in the end those small amounts add up to more than you thought? That’s why it’s very important to understand how we spend our money.

Knowing our consumption habits in the most complete way gives us a global and complete vision of how much we spend per month, but above all on what we spend it on. This knowledge allows us to keep our expenses in check, control our state of debt and detect what we are spending too much on and, as a consequence, what we can save more on. Blessed savings!

The first and only rule in expenditure control is… to be constant! And to this end we propose three methods to control your expenses without losing yourself in the attempt:

- App: There are many mobile apps to keep a thorough control of your expenses. The most useful are, without a doubt, the apps that are linked to your financial products such as a bank account or equivalent. In that app you will be able to have all your movements registered automatically and it will be very easy for you to check them. There are some apps that even allow you to classify your expenses by category. If this is not your case or you don’t have a bank account, but you want to keep a thorough control of your expenses, don’t worry, there are other apps you can use! These apps will allow you to divide the expenses you enter into categories. For example, you can add an expense for trousers and add it to the “Clothing” category. At the end of the month, you will be able to see in percentages what you have spent the most money on this month and detect whether it was your intention to spend that money on clothing, food or transport, among others.

- Spreadsheet: If you prefer not to download an app, spreadsheets are a good alternative. In Excel, Google Drive or any other software you use is a good option. These spreadsheets will allow you to note down your expenses (which you can name within a category) and have them added up automatically. As the month progresses, you will see how much money you have spent. A good thing you can also check on your mobile phone and from your computer!

- Paper and pencil: Maybe it’s the most manual, but it’s a classic! If you prefer paper and pencil, make sure you always carry a notebook in which to write down all your expenses and don’t forget to write down those small expenses that go unnoticed during the day, such as a coffee, a bus ticket and many more.

2.1.2 EXPENDITURE PLAN

Once you have an overview of how much you spend and on what you spend your money, you will have a real picture of your spending. It is very important that, after this first step, you know what percentage of your money you spend on each thing, in other words, what percentage of your money you spend on each category (50% on food, 10% on remittances, 5% on clothes, 12% on transport, etc). Does what you spend in each category match with what you consider your priorities? This is a key question to ask yourself! It’s important that your expenses and priorities go hand in hand, and if they don’t, you will have detected an opportunity to improve your finances!

This is the main objective of financial literacy, so learning how to plan our expenses is part of the learning process! Once we have controlled our expenses, we must set out on the basis of our budget what we want to spend our money on. But we have to do it in a specific way: “This month I will spend 10% of my expenses on remittances for my family”. By setting exact percentages, we will have defined exactly what we want to spend the money on and how much. Once you are clear about this, you can compare it with the expenses reported the previous month. Then you can:

- Check that your expenditure plan corresponds to your budget.

- Adjust the money you spend on some categories and/or prioritise others. For example, if you indicate in your plan that you want to spend only 15% on transport, but in fact you spend 25% of your money each month, you can readjust it or look for cheaper alternatives such as cycling.

- In the same way, you can detect if you spend a bit more than you’d like – for example on clothing – and save that money. It would be great to be able to save that little extra cost and invest it in a trip home, food or anything else you consider important, don’t you?

- Finally, by drawing up a expenditure plan you can find out every month what your fixed expenses will be, such as 30% of rent, electricity or water, and how much money you will have available for contingencies or savings. In addition, you will be able to see if your expenses are getting out of control and act in time. You will have the control of your finances!

How should I distribute my expenses? There are many theories, although the best one will always be the one that best suits you and your family’s needs. Today we share with you the principle of ‘Pay yourself first’: This principle involves reorganising family expenses by dividing them into monthly savings, essential, extraordinary, unforeseen and dispensable, giving them different priorities. With the ‘Pay yourself first’ principle, when your next salary comes in, the savings should be your first monthly expense!

2.1.3 TIPS FOR RESPONSIBLE CONSUMPTION

Once we have decided how much money we spend and how we want to spend it, we have to learn how to spend it. This is another key point of financial literacy. Knowing how to spend will make your life much easier and your management much more efficient!

These are some of the tips for consumption that your budget will thank you for:

- Consume responsibly: stay within your monthly spending plan and don’t spend more money than you can really afford. This will avoid a lot of headaches!

- Can you pay in installments? Distributing your expenses over several months will give you a break!

- “Do I need this?” It’s a difficult question, but it’s good to ask yourself before you buy something: if you don’t need it, don’t buy it; but if you need it, buy it without regret. This question is just a filter to avoid impulse buying!

- Compare is the key! Compare before you buy, and at the end of the month you’ll see how the small amounts of money you’ve saved by comparing will give make you smile at the end of the month.

- Keep up with offers and discounts on products you are interested in, follow their social networks and look for promotions. They often come at the right time and make your day! And if not, you can always delay some purchases to times when you know the price will go down, such as the sales in each country. How many times have we bought the same product as a friend, but at a higher price?

- Avoid over-indebtedness as much as possible. Savings will help you at this stage!

- Do you send money to your loved ones in your homeland? With Moneytrans you can simulate your money transfer and wait for the day when the exchange rate is more convenient, so your relatives will receive more money at their destination!

2.2 SAVINGS

2.2.1 THE IMPORTANCE OF SAVINGS

Saving money is one of the most important tasks for all of us! Saving some of our money for the future will be very beneficial, and being prepared for unexpected domestic problems, health needs or a trip home is priceless peace of mind!

There is a perception that those who have more money are those who save the most. However, this is a far cry from reality. There are people who have a large income but also spend a lot, so their ability to save is very low. And people with low incomes but who organise themselves to spend what they need, thus having a greater ability to save money. In the end, the ability to save money is just about the degree of financial education: how I manage my finances and if I am doing it well. That’s why, thanks to financial literacy, we can learn how to make the most of our savings!

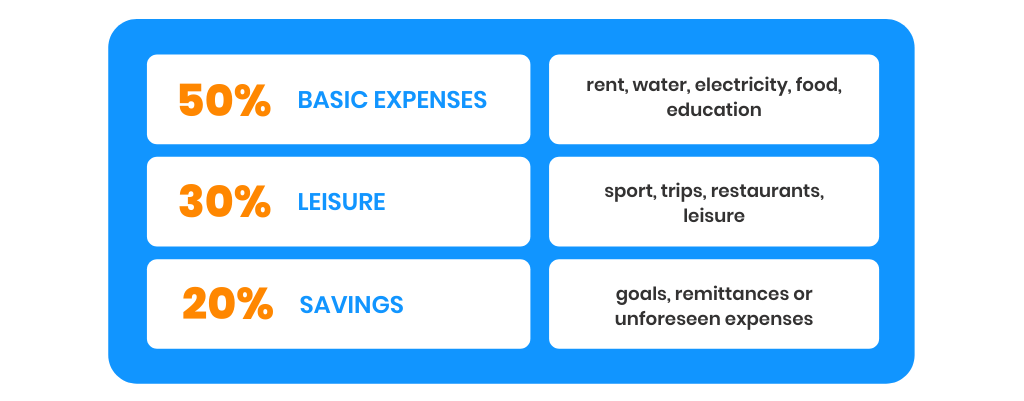

And the big question is … How much money should I save? Here is one of the most common rules to guide you: The 50/20/30 Budget Rule

However, every budget is different and the needs and priorities of each family are different. That’s why a methodology can be valid for one family and not for another one, as well as a percentage of savings. That’s why you should be the one to make the expenditure and savings plan that best suits you and your family! Your success will depend on your commitment and that of your family. Thats why it is very important that the kids in the house also start to know more about financial literacy through games in which they practice it. Their understanding will be of a great help on a day-to-day!

2.2.2 TIPS TO SAVE MONEY

Everybody has always heard that we have to save money, but not everybody has the tools to do it. Here are some of the tips that will help you save money at the end of the month:

- Set an amount aside at the beginning of the month: As the month goes on, expenses increase and it becomes more difficult to set aside an amount to save. Therefore, it is best to set aside an amount to save at the beginning of the month and, if it is possible, separate it from the rest of the money set aside for the month.

- Set goals: Setting aside certain amounts to be saved by a certain date can be a motivating factor. On the other hand, if you are saving for a dream or something you are looking forward to, such as a trip to see your loved ones in your homeland, the motivation will be double! That’s why it’s important to set yourself realistic goals that will motivate you to keep saving money.

- Compare: It’s the rule of thumb for everyone who wants to save! No matter how small is the amount saved, it will always be welcome. However, be aware that price is important, but you should not forget the quality or security of the service you are hiring. Peace of mind is priceless!

- Follow promotions: For example, if you send remittances, it is important to follow the social networks of money transfer companies such as Moneytrans, which often launch promotions for new customers! Look for opportunities!

- Saving culture: Try to teach this saving culture to your family members, it is important that everyone is aware and becomes a team.

- Reduce expenses in your day-to-day: Did you know that you can save a lot of money with small acts in your day-to-day? Yes, from saving at home with the expense of electricity or water, as well as saving on travelling, on children’s items and even in the office or on the road. You only need to know a few tricks that will help you save small amounts in these areas. Would you like to know more? This article will be very helpful!

- Be constant: Perseverance is one of the keys not only to saving, but in almost every area of life! Be clear about your goal and go for it every day, we are sending you cheers from here!

- Be foresighted: If you have been able to save more than usual for a month, two things are certain: First, congratulations! You are on the right track! And the second one? We recommend that you do not spend it if it is not necessary. This amount is not an extra at the end of the month, it is another amount to save thanks to the good management of your finances. Any extra for your savings should be welcomed and included in your other savings, in the long-term you will appreciate it!

2.3 INFORMATION AND NEOBANKS

2.3.1 FINANCIAL LITERACY AS A DEFENCE

Against the cybercriminals… Financial literacy will be your best ally!The more informed you are about possible fraud or dangers to your financial security, the greater your peace of mind will be. And when it comes to your money, peace of mind is priceless!

This is a key point in financial education, so at Moneytrans we want to share with you useful tips to keep your finances safe:

- Do not share your banking or financial information without verifying that you are talking to an official institution.

- Make sure it is a secure website. How can you do that? Look at the address bar at the top of your computer screen: if the URL follows the https protocol and the icon of a lock appears on the left, it means that the website has a security certificate.

- Do not click on suspicious emails or files.

- It is very important that you have an anti-virus on your computer and it is even more important to have that anti-virus protection up to date. On Google you can find free anti-virus protectors that will be a great help in your security!

- Make sure you use secure Wi-Fi networks.

- Use secure passwords: not too short, containing upper and lower case, and even interspersed with numbers. Also, it is highly recommended that you change them from time to time!

- Find out about new forms of cybercrime. The more informed you are, the faster you will detect the danger.

- Beware of scams in forums or social networks. If you want to be part of an initiative that affects your personal finances, it is better to investigate as much as you can about that initiative.

- Read the fine print carefully.

- Do you send money to your homeland? Having a guarantee of fund or mechanisms to cancel your money transfer in case you request is one of the advantages of sending money with Moneytrans. We are transparent!

- And, this is precisely the last advice: Look for transparency in the financial institution you choose to deposit your money!

2.3.2 NEOBANKS ARE MADE FOR YOU

Information is power, and financial literacy is power too! The more informed you are about your finances or the financial products on the market, the better decisions you can make. One of the big mistakes when you migrate to another country is to accept traditional financial products and banks that don’t really suit your basic needs and, as a consequence, to have dispersed financial providers.

Having different entities for your financial needs makes you lose time and money: a local European bank where you receive your salary, a money transfer service to transfer abroad, a home savings service, a short-term credit broker, etc.

In opposition to traditional banks, there are financial institutions that offer digital and mobile payment solutions in one place: they are called neobanks. Because they have little or no cost for maintaining physical branches, they can offer better prices. This is so much so that Accenture estimates that neobanks are up to four times cheaper than traditional banks!

In 2019, remittances sent by millions of migrants around the world reached a peak of $554 billion, representing more than 5% of the national wealth of at least 60 low- and middle-income countries. This money is an essential lifeline for the beneficiaries of these heroes, especially in rural areas. It finances the basic needs of an entire family, but it is also a generator of growth, allowing thousands of people to open their own businesses. Under these conditions, it is very important to find a money transfer provider that is committed to technology and the digitalisation of their services, since they significantly reduce costs. In fact, at Moneytrans we reduced, for example, our customers’ remittance costs from 5% to 3% with our iMoneytrans platform.

Moneytrans is thus becoming a neobank to offer a solution to lower these financial expenses: we built the first financial services platform specially dedicated and adapted to migrants! One place for all your financial needs, while focusing on the essentials: receiving, sending money and making payments!

Our Managing Director of Moneytrans Spain, tells us all the benefits of a neobank!

Check out our website to find out more!