Payment methods have evolved to the present day, generating alternatives to cash such as cards that offer greater security and convenience. Having a card means being able to carry your money with you at all times and use it whenever and wherever you need it. The most common ones are credit or debit cards. And if you are also thinking of getting one, it is important that you know in depth the differences between debit and credit card so that you can choose the most suitable option for you. Shall we get started?

What is a debit card?

The debit card is a very useful payment tool for everyday life. With this card, you will be able to make payments on the spot and spend only the balance you have in your account. By not being able to spend more than their balance, the you won’t acquire any debt with the issuing entity.

In addition, to protect your money against possible theft of your card, you can set your own spending limit if you wish. For instance, you can set a maximum of €300 to be spent in a day with your card. You can also block it whenever you want. On the other hand, these types of cards tend to have lower fees than credit cards. Some payment institutions such as Moneytrans provide a debit card completely free with the opening of a current account.

What is a credit card?

A credit card is a payment tool whereby the customer, unlike a debit card, can use more money than they have in their current account at the time. This happens because your card is linked to a credit line, i.e. the bank establishes an amount of credit or money that you will be able to use, but that you will have to pay back later. For example, imagine you have €500 in your account and a credit card with a spending limit of €1,000. If you spend more than €500, you will be using money that the bank lends you and that you will have to pay back.

In this way you will be able to finance some purchases. However, you should be careful, because in the end you will be incurring a debt with the bank. For this reason, these institutions carefully consider who to give a credit card to. You can decide whether to pay back the money at the end of the month or in installments with interest.

It is therefore important that you are clear about the purpose of your card, the differences between a credit or debit card and the risks you are willing to take when you take on debt.

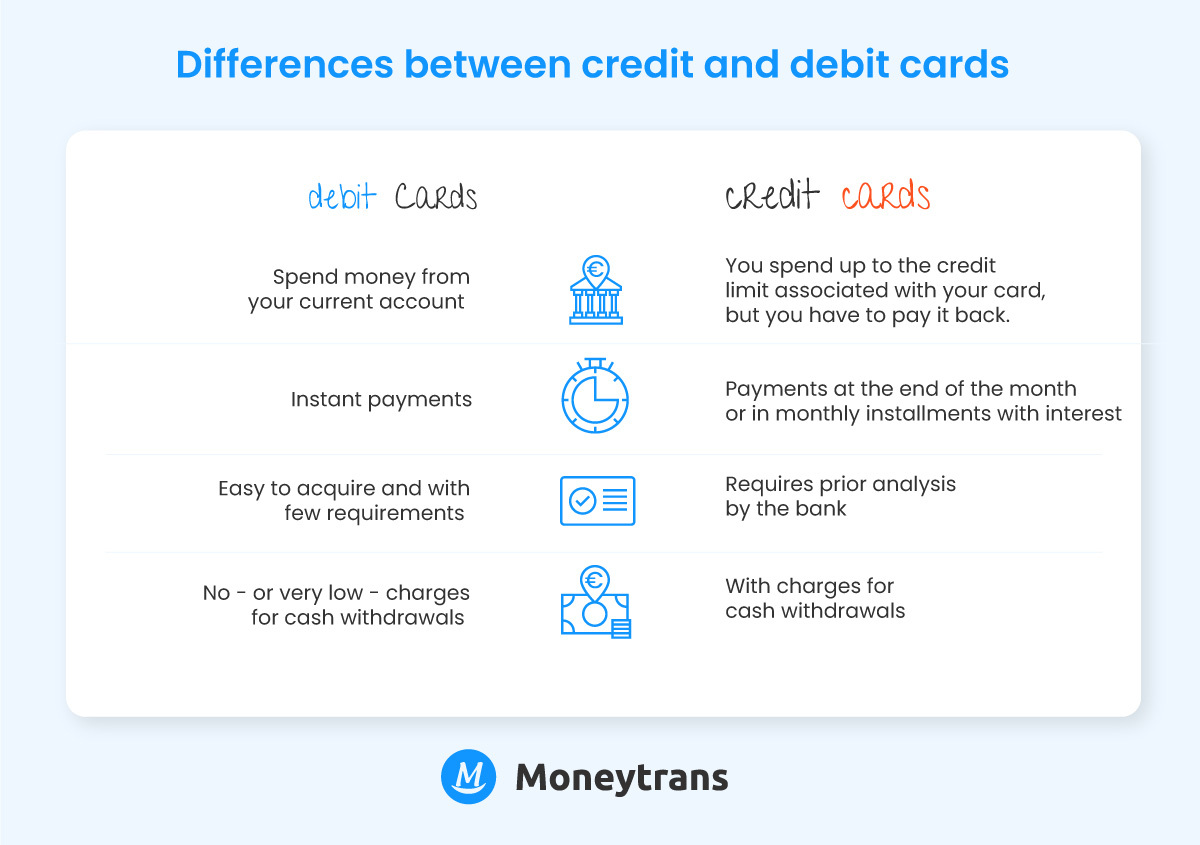

Main differences between credit and debit card

If you are thinking about getting a card, it is important that you first get to know all the differences between a debit or credit card to see what really suits you and your needs. Once you’re clear, you can decide between a credit or debit card with confidence!

Own money or borrowed money

Debit cards: one of the advantages of debit cards is that you only spend what is in the account associated with the debit card, so, by not exceeding that amount, you don’t incur any debt with the financial institution in question.

Credit cards: credit cards allow you to use an amount of money that you do not currently have in your account. However, you have to bear in mind that this is money that the bank lends you and that you will have to pay back within a specific period of time. For this reason, it is usually less accessible than a debit card.

Methods of payment

Debit cards: the money is instantly deducted from your account, you will always see the actual balance.

Credit cards: if you have made payments with your card and you need to refund or return money to the bank, there are several ways to do this.

- Full payment at the end of the month.

- Deferred payment by a percentage of the debt or a fixed monthly payment, but with additional charges. However, you should be cautious, as sometimes this interest can be abusive.

Maximum amount

Debit cards: The limit on your debit card is the money you have in your associated current account, so if you have €300 in your account that is the maximum amount you will spend. You are in control of what you spend, without debt.

Credit cards: the limit on your card will depend on the amount of money or credit the bank has granted you. This means that if the bank gives you a card with a credit line of €1,000, you will be able to use that borrowed amount regardless of whether you have less money in your account. However, remember that the money you use that you do not have in your account is borrowed and therefore you will have to pay it back.

Withdrawing cash from cash machines

Debit cards: you can withdraw cash for free or with very low commissions.

Credit cards: in the case of credit cards, you will have to pay commissions when withdrawing cash at ATMs, even at your own bank’s ATMs.

Terms of contract

Debit cards: debit cards present very little risk for the financial institution because they do not allow the customer to get into debt. And, precisely for this reason, it is easier for the financial institution to grant you a debit card if you do not have savings or a regular income.

Credit cards: in the case of credit cards, since they allow the customer to use more money than the balance in his or her account, and therefore get into debt with the bank, the bank usually has requirements such as a minimum income, no other debts, etc. Therefore, the bank in question will carry out a prior analysis of the customer’s profile.

Associated insurance

Debit cards: These types of cards usually have basic theft or anti-fraud insurance associated with them. In addition, there are already accounts such as the Moneytrans Smile Account that offer free life insurance with the opening of an account.

Credit cards: These cards also usually include travel, online payment or accident insurance.

Which card should you use?

Credit or debit card? That’s the question you’re here for and we’ve got the answer. If you are a resident of foreign origin and you are looking for more accessibility, a debit card is perfect for you. Since you don’t need many requirements, it is easy for a payment institution to grant you a debit card. On the other hand, this type of card allows you to spend only what you have, without the possibility of getting into debt. No doubt, avoiding debt will take away more than one headache.

In addition, you will have control of your spending at all times, payments are deducted immediately, so you can see your actual balance whenever you want. Finally, the commissions for cash withdrawals are usually non-existent or very low.

Get your card for free with Moneytrans

If like many other residents of foreign origin, you are thinking of having a credit or debit card too, by opening a Moneytrans Smile Account you can get a Mastercard debit card completely free of charge.

After more than 20 years of handling the remittances of millions of expatriates, Moneytrans has launched the Smile Account, a current account designed by and for residents of foreign origin. Without the complications of a bank and with the same security and confidence as always. Thanks to the Moneytrans & Mastercard alliance, with the Smile Account you receive a free debit card in your name for your day-to-day life:

- Pay and buy like a local: with your Mastercard you will be able to make purchases in physical and online shops and online shops all over the world. In addition, you can make contactless payments at any establishment.

- Withdraw cash wherever you want: withdraw cash at any ATM or Moneytrans branch is possible thanks to the card associated with the Smile Account.

- No hassle: Did you know that you can open a current account without a bank? Many payment institutions are already licensed to offer current accounts that are accessible with maximum security. Say goodbye to the complications of traditional banks with Moneytrans.

- No surprises: as a debit card, there are no surprises – you only spend the money in your current account.

- Complete control: you can manage your card payments with a single click thanks to the iMoneytrans multiservice app or from the Moneytrans website.

- Maximum security: your card and Smile Account have robust security systems to guarantee their protection.

- Anti-fraud system: we track transactions 24/7 to detect and prevent fraud.

- Anti-theft protection: If your debit card is lost or stolen, you can block it instantly from the Moneytrans app or website.

- 3D Secure: this is an identification system whereby every time you make a payment with your card you will have to enter codes to verify that you are the one making the payment.

Don’t wait any longer! Open your Smile Account now and receive a free Mastercard to enjoy the financial freedom you deserve.