Open your current account online in Belgium in 5 min

Finally an account for everyone! Open yours with your passport, ID or residence permit and benefit from 1 account, 1 Mastercard and 1 IBAN for only 20€/year!

Discover the bank-free account designed for international communities

- A current account with an IBAN + a super multiservice app to manage all money matters for only 20€/year

- With a personal Mastercard for free

- With 50% discount on your international transfer fees at your Smile Point of Sales

*Minimum initial deposit of €5, immediately available in your account

Easy to open, easy to use

5 minutes and it’s yours! Because with the Smile Account we only ask you for what is really needed, and you have it at hand!

Open your account now with your ID card or passport and take control of your money!

An account for your daily transactions

Send and receive money

Deposit and withdraw cash

Make direct debit deposits

Paying bills in Europe or abroad *

Top up a mobile phone abroad

Accident/disability insurance and repatriation of the body

* Coming soon

Incredible discounts all year round!

If you pay your money transfers abroad with the Smile Account, you will get discounts on your fees all year round.

- 25% off if you make your transfer online.

- 50% off if you do it through a Smile Point of Sales (up to €5 per transfer).

Send money the smart way with the Smile Account!

Enjoy a free Mastercard

When you open your current account, you will receive a free Mastercard, which is accepted worldwide – in stores, online, ATMs and Smile Points! Whatsmore, you can unlock rewards every time you use your Smile Account card!

Discover more benefits of owning a Mastercard!

One place for your cash

Deposit and withdraw cash instantly at ATMs or at any one of our Smile Points with hundred of Smile Points throughout Europe.

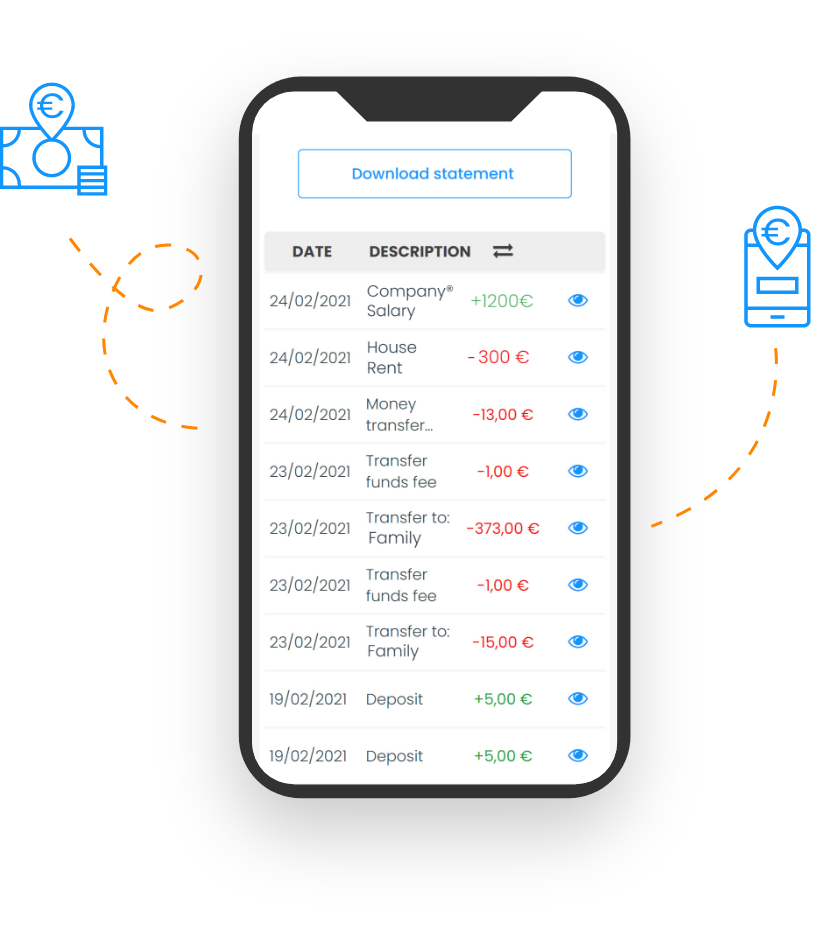

Take control of your finances

With the Smile Account you have full control of your own finances! By managing your finances in a single account, you save time and money Transactions or checking your balance can be done in a single click. Giving you more time to enjoy the things you love most!

An account with the security of a bank but wihout

With no hidden charges

With no slowness or complication

Without direct debit of salary

3 times more economical

Our customers talk about the Smile Account

Now thousands of people have access to a current account and a Mastercard to manage their finances with total freedom.

Thousands of people, thousands of success stories that are inspiring and motivating to all those who want to fly away and start a new life.

A three times safer bank-free account

Entity regulated and authorized by the National Bank of Belgium

Payment system verified by Mastercard

Advanced anti-fraud protection and data encryption technology

Entity regulated and authorized by the National Bank of Belgium

Payment system verified by Mastercard

Advanced anti-fraud protection and data encryption technology

More than just an account

This bank-free account will help enable financial inclusion for millions of citizens living abroad. Unlike traditional bank accounts, Moneytrans is specifically designed for communities of foreign origin by creating a simple and accessible account for everyone. An account that answers all your financial needs in one place, making life that little bit easier.

F.A.Q.

Account opening

- Opening a Smile Account at an authorised branch: watch tutorial

- Opening a Smile Account online: watch tutorial

When you open your Smile Account, you’ll have access to a Mastercard debit card completely free of charge. It will be sent to your home within 5 to 10 days from opening your account. The card and pin are sent separately

This is not a fee: this initial amount is required for the issuance of your card but will not be deducted from your account. You can then spend this amount as you wish.

Payment plans

To open your Smile Account we want to give you the maximum freedom so that you can decide from day one which type of plan suits you best. You will be able to choose between:

Annual plan : With this plan, the maintenance fee will only be charged once a year and what is more important, you will save 42% of the price. You can open your Smile Account, make a one-off payment of €20 and forget about monthly charges until the following year.

Monthly plan:The convenience of small micro-payments. With this plan, you can open your Smile Account and split the annual maintenance fee over 12 months, so each month you will pay €2.90.

You will be charged the first monthly fee when you open your account, and for the remaining monthly payments, your account will be automatically debited the same amount each month.

Information about your rights

Your account number, regardless of which EU country it’s from, should be accepted anywhere in the European Union. Your provider is breaking the law if they don’t accept your IBAN. Report your case, so we can stop it from happening again. All cases of IBAN discrimination submitted through this form will be anonymised. All personally identifiable information will be removed.

IBAN discrimination is when a bank or company doesn’t accept your IBAN because it’s not from the same country in which the bank or company is based.

For example, French IBANs look like this: FRXX XXXX XXXX, and instead, a German bank or company may insist you need a German IBAN which looks like this: DEXX XXXX XXXX, etc.

Let’s say you want to pay for your gym membership in Spain using your German IBAN: your Spanish gym would be guilty of IBAN discrimination if they didn’t accept your non-Spanish account number.

Operating the account

To activate your card, you will need to make a purchase via a contact terminal or a cash machine withdrawal. You can then start using your card to make online or contactless payments.

On your web and mobile client space, through which you can consult and manage your account from A to Z, accessible via our web page: online-pre-tmp.moneytrans.eu If you have opened your Smile account in one of our branches, ask for your client number in order to easily create your Moneytrans user account.

You will find all the data previously encoded in the agency. After having clicked on the “Registration” button, click on “Register with customer code”, insert your “customer number”, your “date of birth” and find all your data.

With the Smile Account you can send and receive payments with no hassle. You can do all this on our online platform. Find out how to manage your personal area here!

If you want to transfer money into your account, you can do it online or at one of our authorised offices.

What’s more, you can withdraw cash from your account at any of our offices.

The only way to check your balance is by creating a Moneytrans user account. If you have any difficulties in doing so, please do not hesitate to contact our Customer Service team.

You can do it in two ways: by going to your nearest authorised Moneytrans branch, where an agent will help you transfer the cash to your account, or via the app or website.

Yes, you can! If you have a Smile Account registered in your name you will be able to top up any national or international mobile phone directly from your personal account by selecting Smile Account as payment method. The top up will be made instantly.

Solving any problems [you may have]

You will receive your PIN code and your Mastercard in two separate envelopes within approximately 12 working days. If after this time you still have not received them, please do not hesitate to contact us. If you have any questions, please contact us Monday to Saturday from 9.30am to 19.00pm by phone on 02 227 18 20, by WhatsApp on 0471 26 38 54 or by email: [email protected]

A bank, internet provider, gym - you name it - doesn’t accept your IBAN and insists you need a ‘local bank account’? While that may seem legit, it’s illegal. It’s called IBAN discrimination, and it’s against the law.

Report your case of IBAN discrimination, and we will pass them on to the relevant authorities, saving you the hassle.

We’re here to put an end to this.

Security

Certain purchases on the Internet, you must enter a security code to validate and finalise your transaction. As soon as you open your Smile account, we will instantly send you this code by SMS. Please keep this code in a safe place so that you can make your payments online as soon as you receive your Smile card. You will be able to modify this code via your customer area afterwards.

Moneytrans Payment Services is a Payment Institution authorised by the National Bank of Belgium to offer payment account services (Smile Account). As we are not a bank, we are not backed by the deposit guarantee fund. Consequently, Moneytrans protects the funds of the Smile Accounts by depositing them in a Safeguard Account with ING Bank. This Safeguard Account separates customer funds from other company funds and is segregated, which means that ING cannot collect other debts from the balance in this account.

If your Mastercard debit card is lost or stolen, you can block it instantly from the app with a single click to ensure that no one can use it. You can select the “temporarily block card” option to unblock it at any time, or the “permanently block card” option and request a new card via the “replace card” option.

You can also request a new card by calling our Customer Service, as well as if you want to change your personal details, address or telephone number.

Contact us

HELP CENTER

Your questions are 7/7 and so are we